Simple steps to buying your first home

Read more

We’re offering a great competitive variable rate of 5.27% p.a.^ (5.29% p.a. comparison rate#) on our FlexiDiscount Home Loan.

There's no application or monthly fee, you can make unlimited additional payments and if you're ahead on your repayments, you can redraw for free.

You can manage your loan the way you want to. Think weekly, fortnightly or monthly repayments.*

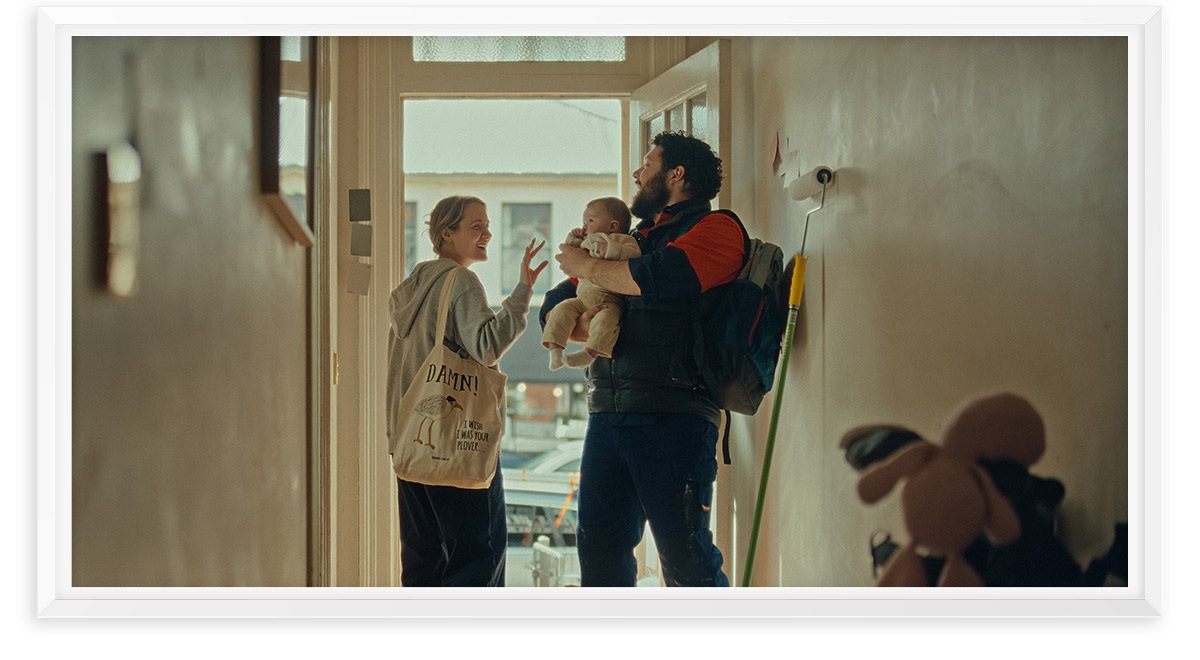

You might be upgrading for a growing family, looking to refinance or downsizing to suit your lifestyle, our FlexiDiscount Home Loan variable rate gives you flexibility and value.

We're not just a bank for the here and now...

Repayment flexibility - you can make additional repayments without penalty or redraw extra funds if you are ahead on your repayments.

No tricky business - it's simple to manage: think weekly, fortnightly or monthly payments*.

Great value – there's no application or monthly fee, just a competitive rate without paying for features you don’t need.

Helping Tasmanians own their future with a smart variable rate

As Tasmania’s only customer-owned bank, we’re committed to helping Tasmanians at every stage of life feel confident about their financial future. Offering simple home loan options like this one is just one way we do that.

Our team of lending specialists can guide you through the options and see what’s possible. Talk to us today to find out how we can help you make your home ownership plans come to life.

With a variable interest rate home loan, your interest rate can move up or down during the life of your loan. Rather than locking in a fixed rate for a set period, a variable rate gives you flexibility- and also a bit more exposure to market changes.

Whether you’re buying your first home, upgrading to fit a growing family, or downsizing for a lifestyle change, this variable home loan is designed to give you flexibility during life’s big transitions. You get a great interest rate without the things you might not need, like an offset account.

With a Bank of us FlexiDiscount home loan you can make unlimited additional repayments without any penalty. If you're ahead, you can also redraw funds if you need to.

Our FlexiDiscount home loan doesn't have a separate offset account but you'll be able redraw funds should you be in advance on your loan repayments.

Talk to us! Our local team of lending specialists is here to help you understand your options, answer your questions, and guide you through the home loan process with confidence. Always seek professional advice for financial decisions.

Lending criteria, terms and conditions, including fees and charges apply. Full details available on application. ^Available for new lending up to 60% property value. Offer may be varied or withdrawn at any time. *Provided the minimum monthly repayment is met.

#Comparison rate based on a secured loan of $150,000 over 25 years.

WARNING: This comparison rate is true only for the example given and may not include all fees and charges. Different terms, fees or other loan amounts may result in a different comparison rate.

This information is general advice only and does not take into account your individual objectives, financial situation or needs