Simple steps to buying your first home

Read more

Lock in peace of mind with our FlexiDiscount Home Loan 2 year Fixed Rate

When life feels uncertain, knowing exactly what your home loan repayments will be can bring peace of mind. That’s why we’re offering a great competitive 2-year fixed rate of 5.19% p.a. (5.42% p.a. comparison rate#) on our FlexiDiscount Home Loan.

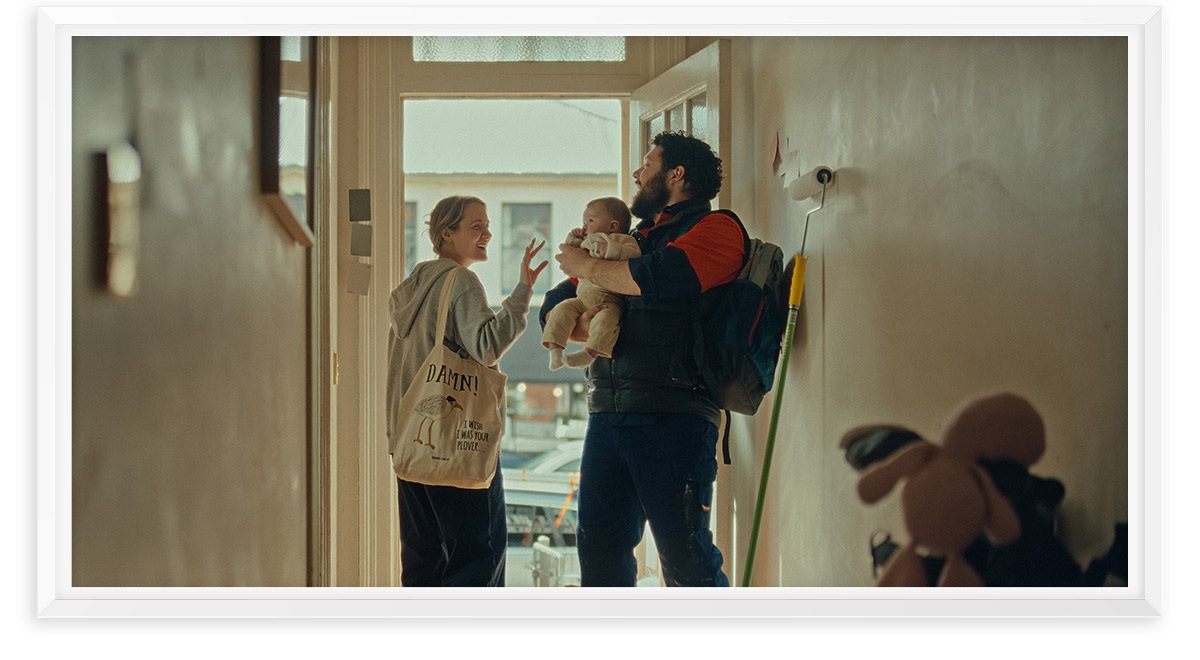

Whether you’re buying your first home, upgrading for a growing family or downsizing to suit your lifestyle, locking in your rate for 2 years helps take one more thing off your plate and gives you financial stability when you need it most.

Why choose a 2-year fixed rate?

· Know exactly what your repayments will be during the fixed rate period — no surprises.

· Enjoy a competitive rate that helps you stay on top of your budget.

· Feel more financially secure so you can focus on what matters most.

We know that life has enough ups and downs already. With our FlexiDiscount Home Loan, if you are borrowing up to 80% of your property’s value you can lock in this great fixed rate for 2 years.

Helping Tasmanians own their future with a smart fixed rate

As Tasmania’s only customer-owned bank, we’re committed to helping Tasmanians at every stage of life feel confident about their financial future. Offering stable, secure home loan options like this one is just one way we do that.

Our team of lending specialists can guide you through the options and see what’s possible. Talk to us today to find out how we can help you make your home ownership plans more secure.

We’re not just a bank for the here and now. We’re for what comes next.

A fixed rate gives you certainty and stability. You’ll know exactly what your repayments will be during the fixed rate period, avoid any surprise rate changes, and make it easier to manage your budget — all while enjoying a competitive rate.

Whether you’re buying your first home, upgrading to fit a growing family, or downsizing for a lifestyle change, this fixed-rate home loan is designed to give you financial confidence during life’s big transitions. You get a great interest rate without the things you don't need, like an offset account.

At the end of the fixed rate period, your loan will automatically revert to our FlexiDiscount variable rate. Before this happens, we’ll get in touch to discuss your options — including refixing for another term or exploring other loan structures to suit your situation.

With a Bank of us FlexiDiscount home loan you can make unlimited additional repayments during the fixed rate period without any penalty.

With Bank of us FlexiDiscount Fixed Rate home loan, you will be able redraw funds should you be in advance on your loan repayments. This loan doesn't feature an offset feature.

Talk to us! Our local team of lending specialists is here to help you understand your options, answer your questions, and guide you through the home loan process with confidence.

Use our online form to generate a Key Facts Sheet PDF which you can use to compare our home loans against a competitor's loans.

Reset

Lending criteria, terms and conditions, including fees and charges apply. Full details available on application.

*Interest rate for loans up to 80% property value.

#Comparison rate based on a secured loan of $150,000 over 25 years.

WARNING: This comparison rate is true only for the example given and may not include all fees and charges. Different terms, fees or other loan amounts may result in a different comparison rate